What an interesting week we had! Risk off again with big increases in JPY and CHF, at expense of USD, GBP and EUR. Watcher big account is now just under 200% up since September last year, small account up at 127%. Since both accounts operate without stop loss, its a bit of an art to get the lot sizes correct so that the account does not become over-traded. I think the changes I made in Jan, just after the account doubled, have now paid off and I am beginning to understand what the grid sizes should be for each currency. I am investigating ways of making this more scientific, so that I am not just kidding myself. My biggest problem is that it is so time-consuming to back-test each pair for any considerable period of time on a tick-by-tick basis. So far all attempts at this have been inconclusive. It's still a matter of watching the screen when my price alerts activate, day after day, week after week, month after month.

Following are some screen-shots of the more interesting pairs:

EURUSD is caught in the risk-on, risk-off mentality of the market. A good pair for grid trading, slots need to be wide and lot sizes small. Count the many take-profits this week!

GBPCHF again showing some violent moves, crossing the nDay midpoint steeply from above and continuing to provide new buying opportunities.

From the length of the red dashed lines in this chart of GBPJPY, you can see that some of the trades now completing have been around for a while. In fact, some of these go as far back as January. The slow blade pierces the shield!

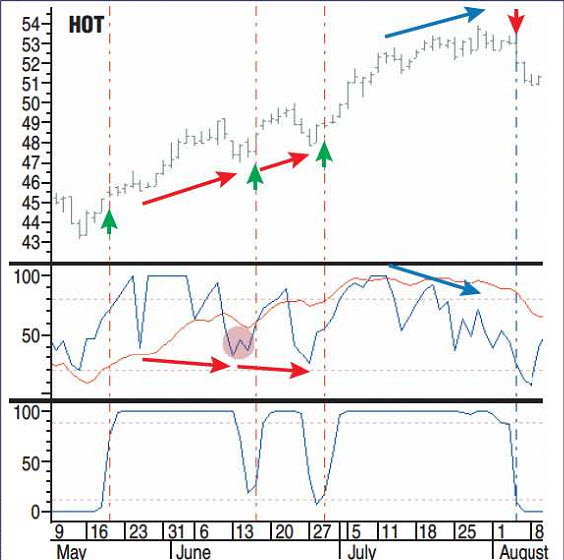

Whenever USDCAD reaches or breaches the nDay low-point, its time for a manual trade. These are always the same size and, once executed, become just another grid trade. I am now waiting for the Swing indicator to turn upwards, and be confirmed by the Smoothed RSI Inverse Fisher indicator, before going long(er). I actually missed the touch of the low-point on 21st, which I was a bit miffed about.

Player of the week award has to go to USDCHF, breaching its lifetime low and continuing downwards. I was ready to buy-in at 93c (plus a tad in case it didn't breach) and was a bit gob-smacked to see how far it went down. I managed to buy in again at the right point, and ended up late Friday with +30 pips. My original trade was up about +12 pips, so I decided to go to sleep and let it ride. Bit disappointed to wake up at 6am this morning to find it about the same number of pips underwater. You can see it almost reached my TP (the dashed lime green line) but there's no prize for that!